AI Credit Decisioning Platform

- Credit Unions

- Auto Dealers

- Banks

- Finance Companies

- Mortgage Servicers

- Community

Automated AI-Powered Credit Decision Technology

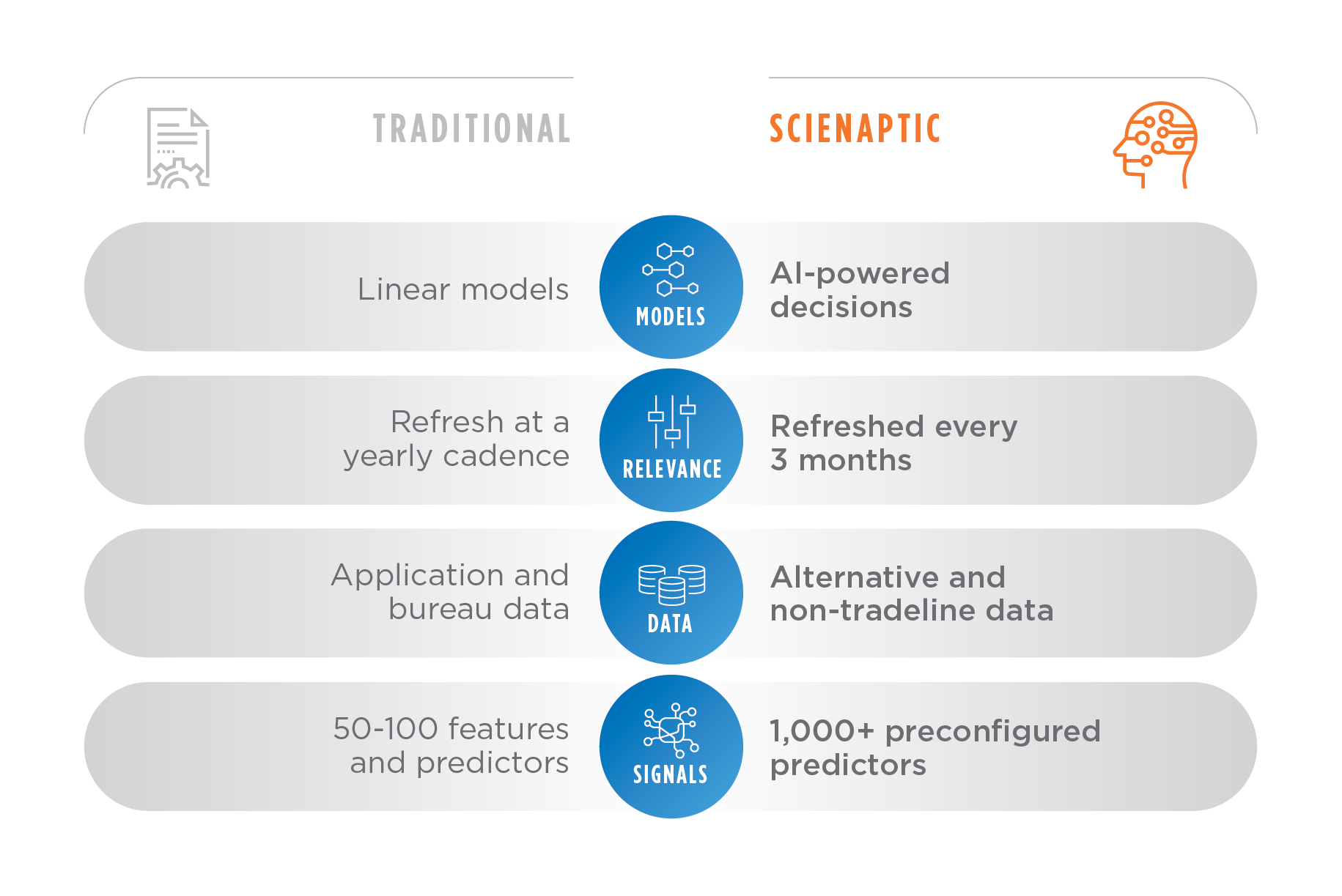

Allied has partnered with Scienaptic to help you confidently expand credit access through AI-powered risk predictions and automated underwriting. The platform integrates more data into your decision-making, utilizes advanced machine learning algorithms, and is reinforced by rigorous risk and fair lending monitoring processes.

Key Benefits

- Score over 90% of individuals without traditional credit histories.

- Approve up to 40% more members.

- Increase approval rates by over 45% for protected classes.

- Automate 60-80% of lending for more effcient operations.

- Achieve a 10-50x return on investment.

- Leverage inbuilt lifecycle decisioning for fraud detection, cross-sell, up-sell, line management, bundled offers, early warning signals, and more.

Today, over 150 lenders rely on Scienaptic's platform to enhance the accuracy and efficiency of their underwriting decisions. The platform processes over 3 million credit decisions each month, evaluating loan applications worth more than $3 billion. This enables over 1.3 million underserved individuals every month to access credit opportunities that were previously out of reach.

In September 2024, Scienaptic's CUSO received strategic equity investments from six credit union clients, underscoring the transformative power of its platform. Today, the CUSO is backed by 10 strategic investors, underscoring Scienaptic's deep commitment to the core principle of "people helping people."

Let's Get Started

Improve customer service experience, increase revenue, and reduce costs with an omnichannel virtual assistance ...

Learn MoreAuto Loan Default helps you expand your portfolio by identifying and targeting a greater number of high-yielding ...

Learn More