This article was originally published on Credit Union Insights

As interest rates continue to rise, credit unions are likely to experience an ongoing rise in delinquencies and collections. In this economy, this can be a significant challenge for credit unions, as delinquencies and collections impact your bottom line and ability to continue lending to members. Therefore, it’s essential to implement strategic solutions to combat and offset these conditions.

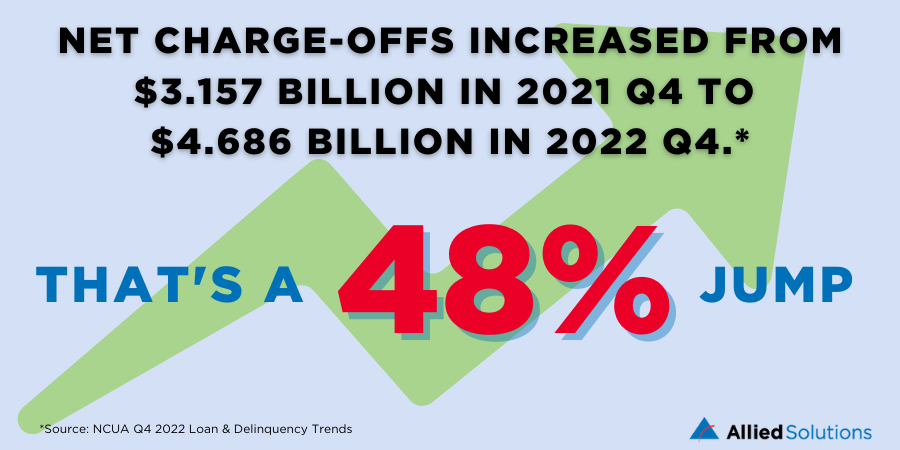

Based on the NCUA Q4 2022 Loan & Delinquency Trends, there was an increase in net charge-offs from $3.157 billion in 2021 Q4 to $4.686 billion in 2022 Q4.

That’s a significant 48% increase.

Higher loan losses can lead to reduced profitability for credit unions and may also signal economic weakness or instability. Additionally, higher loan losses can make it more difficult for credit unions to extend credit to borrowers, which could have a negative impact on member spending and economic growth. This increase in net charge-offs in 2022 Q4 is a cause for concern for credit unions and the broader economy. It’s difficult to predict with any amount certainty what will happen in 2023, but credit unions may need to take steps to reduce their exposure to loan losses and be prepared for a persistent weakening economy.