As guardians of your institution, you know that innovation is the cornerstone of progress. However, fostering innovation requires more than just acknowledging its importance; it necessitates a culture that embraces change and promotes adaptability. In today's rapidly evolving financial landscape, the role of innovation and adaptive leadership has never been more crucial. From the lingering effects of COVID-19, to a liquidity crisis, to a looming recession and more, economic turbulence demands that credit union and banking leaders champion a culture of adaptability and leverage current technologies to gain ground on this rocky terrain.

Innovation starts with a willingness to change. The financial landscape is constantly evolving, and institutions must keep pace. Effective leadership is paramount, especially during tough times. This involves being open to new ideas, views, and especially ever-changing technologies. Innovation often arises from the ground up, and the inside out. Providing continued education and staying current with evolving tech advancements can foster an environment where employees feel empowered and excited to do their jobs, which may not only benefit your institution, but your community as well.

There’s More Than One Way to Invest!

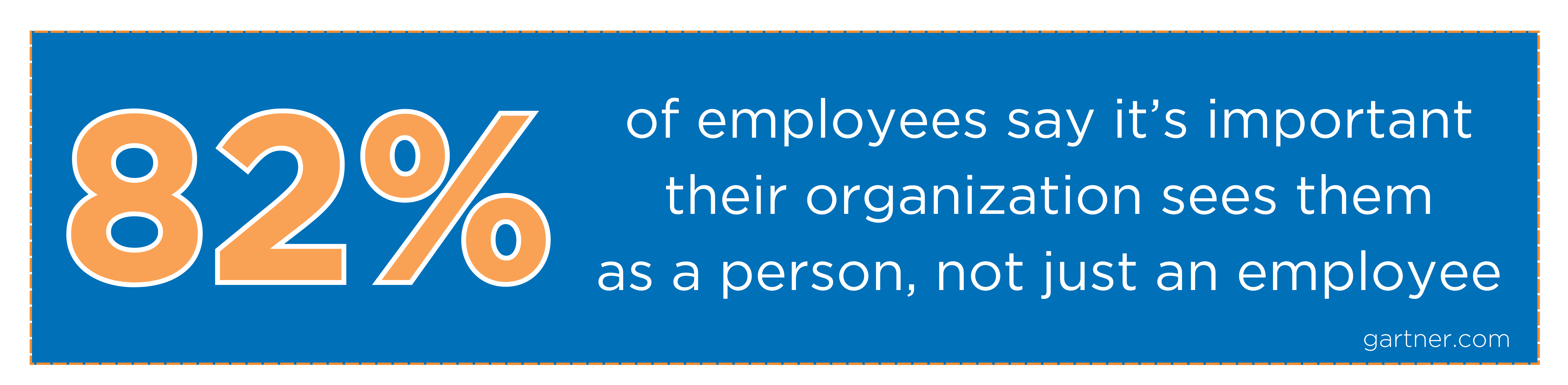

In this industry, investing is typically related to seeing some sort of financial profit or gains. But take a look inside your four walls (literally) at the people behind your institution — where the heart of your bank or credit union lives. They not only look to you to be their guiding light, but also their source of empowerment. Make investing in them a priority.

Powerful leaders should commit to the ongoing development of their employees by providing opportunities for skill enhancement and career advancement. Cultivate a culture of continuous learning, where employees are not just encouraged but also helped in acquiring new skills, adapting to evolving roles, and staying attuned to industry dynamics.

It's necessary to recognize the profound interconnection between employee engagement and customer satisfaction. Engaged and motivated employees are more likely to deliver exceptional member experiences. Thus, investing in your team's well-being and development is an investment in your institution's success. Take a deeper dive into how to cultivate and engaged workforce in our recent article, "The Three Basic Needs of a Successful Employee (and How to Foster Them)".

Invest in yourself! Sometimes it’s hard to put yourself first when leading a company, but similar to the oxygen mask directions given pre-flight, you must prepare yourself before you can help others.

Leverage Technology for a Competitive Edge

The digital age has pushed an intense transformation in the financial industry. You can take a more focused look at that here. Credit unions and banks that remain resistant to technological integration will, to be blunt, be left behind. As a leader, you play a pivotal role in championing the integration of cutting-edge technology into your institution’s operations.

If you are not currently, you should be allocating resources toward digital banking solutions, mobile applications, and AI-driven customer service tools — to name a few. These innovations not only elevate member experiences but also streamline internal processes, making your credit union or bank more efficient and cost-effective.

In a vigorous economic landscape, data emerges as your most formidable ally. Embrace the power of data analytics to gain deeper insights into consumer behaviors, market trends, and risk assessment. These precious insights can help guide what technology to focus on first to best benefit your institution and its customers. Data-driven choices will empower you to mitigate risks more effectively, identify untapped growth opportunities, and allocate resources with precision.

Navigating the furious waters of the financial world, the principles of innovation, adaptability, and leveraging technology must serve as your north star. By supporting these principles, you reinforce the resilience of your institution and its people, ensuring its ability to thrive amidst economic upheaval. Remember, it’s not only about evolving with the current times but also leading the transformation that will shape your institution's future.