Origianlly featured with CUInsight.

One of the persistent challenges credit unions face is managing delinquencies effectively across various loan types. Delinquency management and collections strategies are not just about recovering overdue payments but are integral to maintaining the financial health and sustainability of credit unions and members alike.

Understanding delinquency management

Delinquency—the failure to make timely payments on loans—poses significant risks to credit unions’ portfolios. Whether it’s auto loans or mortgage loans, understanding the factors contributing to delinquency is vital. Economic fluctuations, personal financial crises, or unexpected life events can all lead to payment defaults. Therefore, proactive delinquency management becomes essential to mitigate risks and protect credit union assets while fostering stronger member relations. Let’s take a closer look.

Analyzing current trends

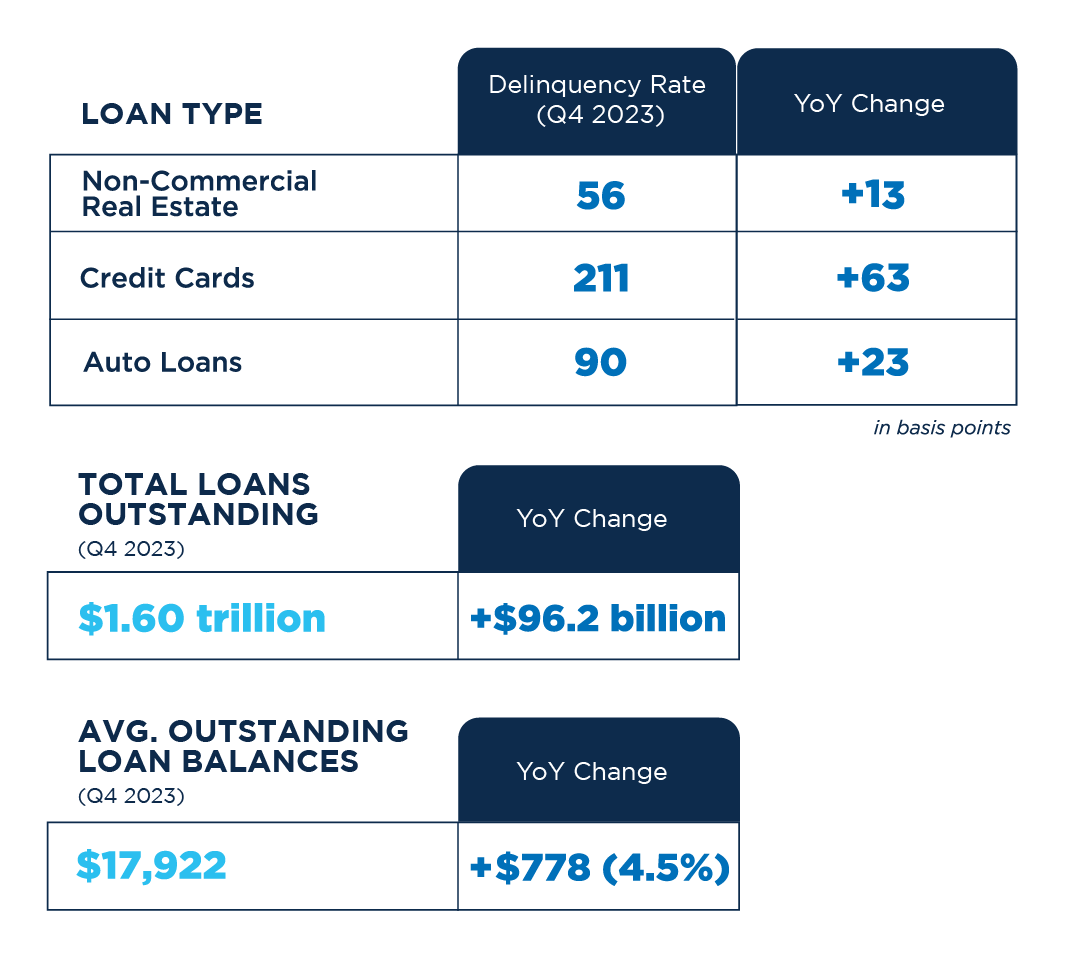

According to a recent NCUA Q4 2023 report, federally insured credit unions are experiencing a notable increase in delinquency rates, particularly in non-commercial real estate loans, credit cards, and auto loans. Despite the rise in delinquencies, total loans outstanding also saw a considerable increase. This trend underscores the importance of implementing effective strategies to address delinquencies across various loan categories.

Interest rates are commonly cited as a factor exacerbating delinquency conditions for both members and lenders. Recent remarks from Christopher Waller, a member of the Federal Reserve Board of Governors, provided no indication of reprieve any time soon.1

This is why understanding the factors contributing to delinquency, such as economic conditions and individual financial circumstances, is crucial for credit unions in developing targeted solutions for success.

Improve lending activity

Auto loan default is a common challenge faced by credit unions. Factors such as job loss, medical emergencies, or vehicle accidents can contribute to payment defaults. To address this, credit unions must implement robust strategies for preventing delinquencies, including thorough borrower assessment and effective loan structuring. Auto loan default programs represent more than just a financial offering—they embody a strategic vision for credit unions to thrive in an ever-evolving market.

Mortgage loan default can have far-reaching consequences for both members and credit unions. Economic downturns or personal financial hardships can lead to missed mortgage payments, putting borrowers at risk of foreclosure. Early intervention and open communication with delinquent borrowers are key to exploring alternative solutions such as loan modifications or forbearance. Additionally, leveraging escrow direct pay services can ensure timely payment of property taxes and insurance, reducing the risk of mortgage default and foreclosure.

Credit unions can expand underwriting guidelines to boost loan volume for HELOCs, home improvement loans, and second mortgages while ensuring protection against loss. In the event of default, file a claim to avoid foreclosure and report zero losses on your balance sheet.

Improve loan quality

In today’s digital era, credit unions have access to advanced collections technologies that streamline communication, payment processing, and data analysis. Automated communication tools and sophisticated software enable credit unions to engage with delinquent borrowers more effectively while maintaining compliance with regulations. Credit unions have a real opportunity to leverage collections technology which not only reduces delinquencies but also boosts member satisfaction and loyalty, without adding significant overhead.

Delinquency management services & partnerships

Credit unions can also benefit from outsourcing certain aspects of delinquency management to third-party service providers. From skip tracing to legal services and predictive forecasting, partnering with specialized vendors can enhance efficiency and effectiveness in recovering overdue payments. However, credit unions must carefully evaluate potential partners based on their expertise, reputation, and adherence to ethical practices and regulatory requirements.

Establishing partnerships with reputable repossession and remarketing companies is critical for credit unions dealing with defaulted loans. By outsourcing remarketing to experts in the field, credit unions can optimize recovery rates and minimize losses on repossessed assets. Doing this while improving efficiency and overall results in repossession, skip tracing, titling and liquidation, ultimately safeguards your financial stability.

As we navigate the challenges presented by delinquencies, it’s clear that proactive management strategies allow credit unions to remain agile in adapting their approaches to meet the evolving needs of their members and the broader financial landscape. By embracing and redefining innovation, leveraging advanced technologies, and fostering strategic partnerships, credit unions can successfully mitigate risks and enhance their lending activities.

1 https://apnews.com/article/inflation-federal-reserve-economy-7fdd01c4a65a762d3edf2db61194b4a2