If 2021 and 2022 had a winner of the year, it would be homeowners. This span of time produced a sellers’ market as interest rates hit record lows and home prices soared – with homes selling almost as fast as they were listed. In addition, refinancing boomed as homeowners looked to reduce their monthly payments and cash in on their home equity. But, every peak has its valley, and the excitement started to diminish as talks and debates of a recession started to stir.

One might think recessions of the past would easily help to determine if we are in one or about to be without much question (2008 wasn’t that long ago, right?). However, what we learned from 2008 (aka The Great Recession) along with subsequent changes and advances (like how financial institutions can better protect themselves), and of course – the pandemic - over the last 14 years have ultimately altered how accurately we can predict future recessions and their potential effects on the economy.

Recession 101

As a refresher, what exactly constitutes a recession? According to the National Bureau of Economic Research (NBER), a recession is the period between a peak of economic activity and its subsequent lowest point and involves a significant decline in economic activity that is spread across the economy and lasts more than a few months.

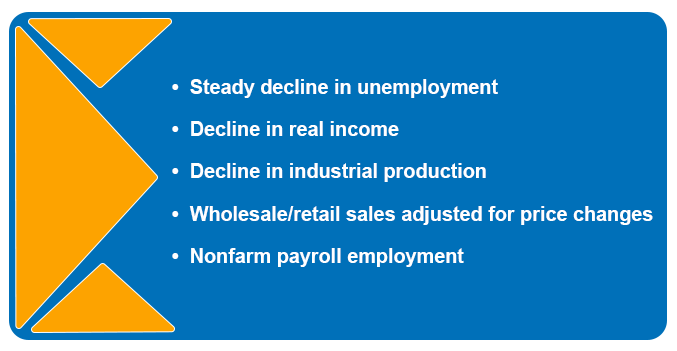

Recession indicators measure a variety of economic activities, such as two consecutive quarters of negative gross domestic product growth (GDP), but also historically include:

The (Not So) Great Recession

Since World War II, the United States has made its way in and out of 13 recessions, with the last one being The COVID-19 Recession in February-April 2020. Still, it’s The Great Recession of 2008 (specifically December 2007-June 2009) that sticks in the minds of most Americans as the subprime mortgage crisis contributed to the longest and most catastrophic economic downturn since the Great Depression, following a housing market boom just a couple of years prior.

The paths to 2008 and 2022/2023 started out similarly. Interest rates in the early-to-mid 2000s were considerably low and those who previously struggled to own a home due to higher interest rates were now able to, creating a housing boom. However, the lack of lender/lendee accountability that helped lead to The Great Recession sets the two paths far apart.

In 2008, loan writing guidelines were very liberal, making it easier for almost anyone to get approved. Some of the guidelines that were followed included:

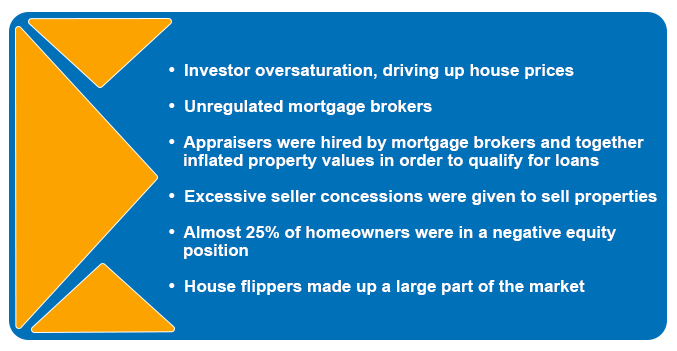

This underwriting recklessness in turn led to an abundance of fraud in the housing market, such as:

The TBA (To Be Announced) Recession

While some recession indicators have been present in 2022 (two consecutive quarters of negative GDP), another strong indicator – a rise in unemployment rates – has not. Unlike 2008, attention is being closely paid to changes in interest rates, inflation, and how the economy is able to adjust. There are also global factors to consider, as with previous recessions, such as being post-pandemic and Russia’s invasion of Ukraine.

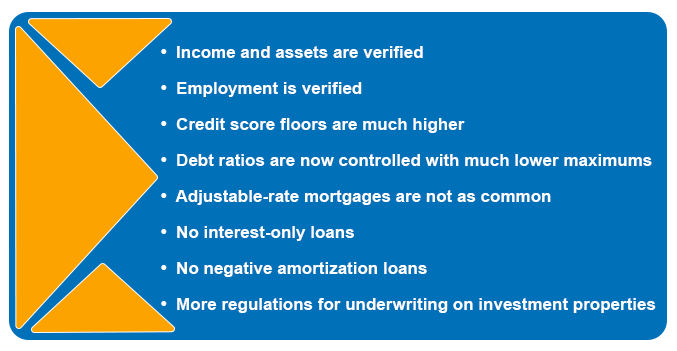

The housing marketing did learn a few things from 2008, especially how to tighten up guidelines and regulations. Now, stricter underwriting guidelines are in place, including:

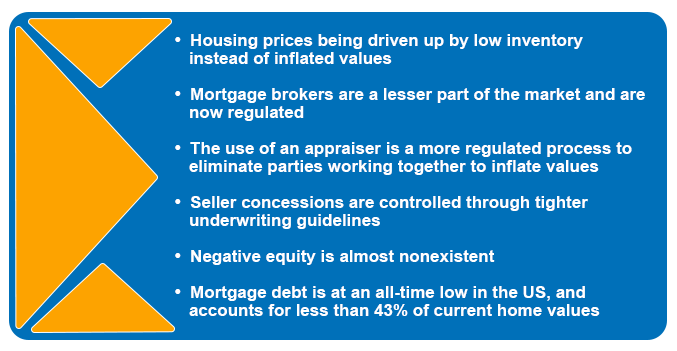

The housing market today is also less susceptible to fraud, thanks to The Great Recession. Now we see a regulated industry that focuses on maintaining a conservative approach to thwart any future mortgage crisis. New regulations include:

A Regulated Recession?

If we can thank The Great Recession for anything, it’s the importance of guidelines and regulations. Recessions will possibly always be a reality, but learning and growing from the previous one(s) can help mitigate the damage and overall effects of future recessions – turning what used to be a catastrophic crisis into more of a regulated decline.