Natural disasters have been a part of the Earth's natural systems since the dawn of time. Galileo once taught that nature is orderly and follows mathematical and physical laws, but nature's complexity often defies predictability. However, through scientific inquiry, we have come to understand the cause-and-effect relationship between human disturbance, such as global climate change caused by burning fossil fuels, and the increasing frequency and severity of extreme weather events. Considering this understanding, it is essential to recognize the impact of natural disasters and climate change beyond just Earth Day or Earth Month, or when disaster strikes. Consideration, preparedness and seeking to solve these concerns should be a constant priority for businesses, individuals, and communities alike.

Natural disasters have been a part of the Earth's natural systems since the dawn of time. Galileo once taught that nature is orderly and follows mathematical and physical laws, but nature's complexity often defies predictability. However, through scientific inquiry, we have come to understand the cause-and-effect relationship between human disturbance, such as global climate change caused by burning fossil fuels, and the increasing frequency and severity of extreme weather events. Considering this understanding, it is essential to recognize the impact of natural disasters and climate change beyond just Earth Day or Earth Month, or when disaster strikes. Consideration, preparedness and seeking to solve these concerns should be a constant priority for businesses, individuals, and communities alike.

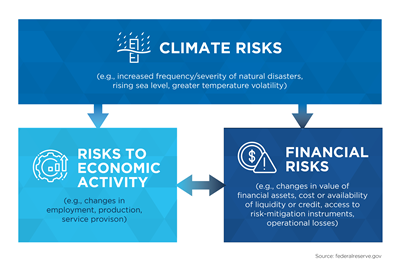

In the past few years, the financial industry, international groups, market players, and other entities have focused extensively on comprehending the consequences of climate change on the financial sector and financial security. Below, we’ve outlined disaster preparedness best practices along with providing information and clarity around common customer concerns.

Preparation is Key

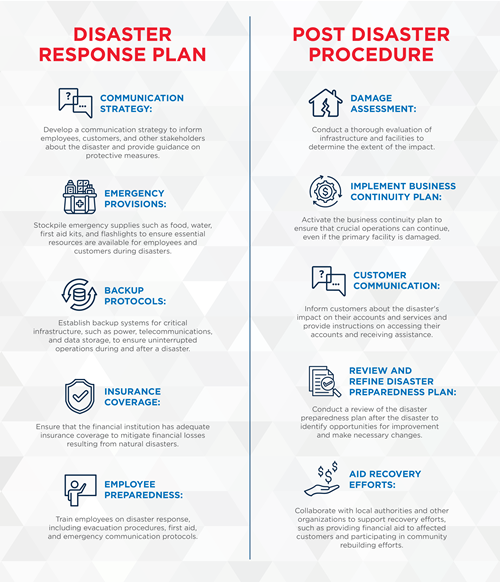

The first step in disaster preparedness is to conduct a risk assessment to identify the potential hazards that could affect your financial institution and those you serve. This includes identifying the likelihood and potential impact of natural disasters such as hurricanes, earthquakes, tornadoes, floods, and wildfires. Once you have identified the potential hazards, you can begin to develop a disaster preparedness plan. Think business disruption, infrastructure destruction, as well as commodity effect and scarcity.

It is challenging to foresee the full scope of the economic effects that a significant natural disaster can cause. Typically, a disaster has a negative impact on the local economy, but it can also have repercussions beyond the affected area. While we cannot prevent natural disasters, we can improve our physical and financial readiness for them. To do so, we must comprehend the economic consequences of a disaster.

Natural disasters can have devastating consequences, but with proper preparation and a well-executed post-disaster protocol, these impacts can be minimized. By conducting a risk assessment, developing a comprehensive disaster preparedness plan, and taking swift action in the aftermath of a disaster, you can protect your employees and customers, while also minimizing financial losses. It is essential to remember that disaster preparedness is an ongoing process that requires regular review and revision to ensure that it remains effective and relevant in the face of changing circumstances.

Common Customer Concerns

Natural disasters wreak havoc not only on the physical environment but also on the financial well-being of individuals and communities. Even after the storm has passed, the impact can be long-lasting, with customers struggling to cope with a range of financial challenges. As a financial institution, being aware of these concerns can help you take proactive steps to assist your customers before, during, and after a disaster.

Financial institutions are encouraged to provide clarity surrounding areas of potential confusion for your customers:

- Concern 1: Missed Payments and Misunderstanding

Confusion: Borrowers may not know whether missed loan payments during a natural disaster will be automatically deferred or placed on forbearance. They may also not know what happens if they overdraw their account during a natural disaster, or what collection actions their lender may take in case of missed payments.

Clarity: Pre-Disaster: To prevent confusion, clearly communicate the terms of deferrals or forbearances with borrowers, including whether missed payments will be deferred or placed on forbearance. Discuss and decide if you want to implement emergency overdraft limit changes during natural disasters and communicate these limits to borrowers. Communicate your collection policies and actions that may be taken in case of missed payments.

Post-Disaster: Proactively communicate with your customers about their options for deferrals or forbearances. Implement emergency overdraft limit changes, if applicable, and clearly communicate these changes to borrowers. Be transparent about their collection policies and any actions that may be taken in case of missed payments. By being transparent and communicating clearly, lenders can help alleviate confusion and stress for borrowers during an already difficult time.

- Concern 2: Upside Down After aTotal Loss

Confusion: If a vehicle is left behind during a natural disaster, will the owner still owe money on the vehicle loan if it's declared a total loss? Households may opt to use their primary vehicle, nevertheless, this does not imply that it is free from an existing loan. If the abandoned vehicle results in a total loss, borrowers may find themselves burdened with an upside-down loan.

Clarity: Pre-Disaster: Proactively educate borrowers about the potential consequences of leaving their vehicle behind during a natural disaster and the risk of being burdened with an upside-down auto loan.

Post-Disaster: Be prepared to discuss financing options with borrowers who have experienced a total loss on their vehicle and may be facing an upside-down loan. It's crucial to clearly communicate the details of their insurance coverage and how it relates to the outstanding balance of their auto loan.

Check out this resource available for download: Managing Total Loss Claims After a Catastrophe

- Concern 3: Avoiding Frauds and Scams

Confusion: In the aftermath of a natural disaster, individuals often experience fear and uncertainty. As they work to navigate through the outcome, they are likely to receive numerous communications from various sources. Deplorably, scammers take advantage of this vulnerability and target those affected by the disaster, potentially resulting in further financial losses for customers.

Clarity: Pre-Disaster: Educate customers on how to identify and avoid fraudulent activities after a natural disaster.

Post-Disaster: Advise your customers to monitor their accounts for signs of fraudulent activity and to contact their provider immediately if they see any charges or other issues. Customers should also monitor their credit report for any unusual activity. Financial institutions should contact all third-party vendors to ensure their communications with customers clearly identify the financial institution and are specific to their issue to avoid confusion and skepticism.

- Concern 4: Rising Rates

Confusion: Individuals who have filed a claim due to a natural disaster may be concerned about potential increases in their insurance rates, which can exacerbate financial difficulties during a time of crisis. This is a common worry among renters, homeowners, and auto owners.

Clarity: Pre-Disaster: Be sure your borrowers are aware of the impact of inadequate coverage on their vehicle and provide them with financial planning resources to prioritize their bills and payments.

Post-Disaster: Customers may be concerned about potential increases in their insurance rates. Advise them to contact their insurance provider to discuss any changes to their policy and provide them with resources to manage their finances effectively.

Financial institutions can play a crucial role in helping their customers and communities navigate through these challenging times by providing clarity on the various financial concerns that may arise. By addressing potential areas of confusion, financial institutions can help alleviate the stress and uncertainty their customers may face. It is crucial to take proactive steps to be prepared and assist your customers before, during, and after a disaster to help them regain financial stability.