Evergreen class action lawsuits are bringing increased attention to ancillary product refunds (such as GAP, Tire & Wheel, AD&D etc.) due when they no longer provide a benefit to the consumer. These lawsuits are raising the stakes for product refunds. There is no time for inaction despite the many challenges of managing product refunds in-house.

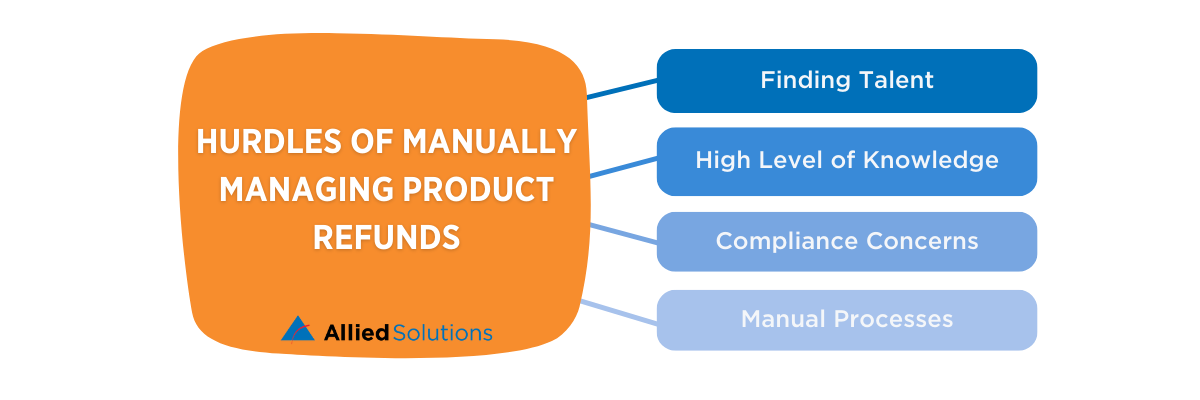

Hurdles of Internally Managing Product Refunds

Finding Talent: Even though unemployment rates are lower than pre-pandemic levels, labor rates are 5% higher compared to last year making it more costly than ever to hire top talent. Across the industry it is increasingly difficult to source and retain talent.

High level of knowledge: In addition to finding and retaining talent, training employees to manage product refunds requires a high level of working knowledge. Product refunds are highly complex and involve multiple parties (typically the financial institution, dealer, product provider, and borrower.)

Compliance concerns: Regulatory pressures from the CFPB and other state regulators continue to escalate. This places financial institutions in a precarious position, balancing the shifting regulatory guidance with the borrower experience. The lack of a fully compliant and automated product refund solution can place financial institutions at increased reputational and financial risk.

Manual processes: Manual, or even semi-manual, processes can cause inefficiencies, tie down human resources and distract from more productive business tasks. Manual processes also create more opportunities for errors and delays, which are particularly risky when it comes to product refunds. Sloppy, non-strategic processes aren’t cutting it for compliance.

There is no room for assumption in this market. Despite these hurdles, it is no longer acceptable for financial institutions to assume that dealers and product providers will manage this process.

So, you might be asking:

How can our organization take on one more process when it is already difficult to find and retain talent?

If you are asking this question, you're not alone.

Is automation the answer?

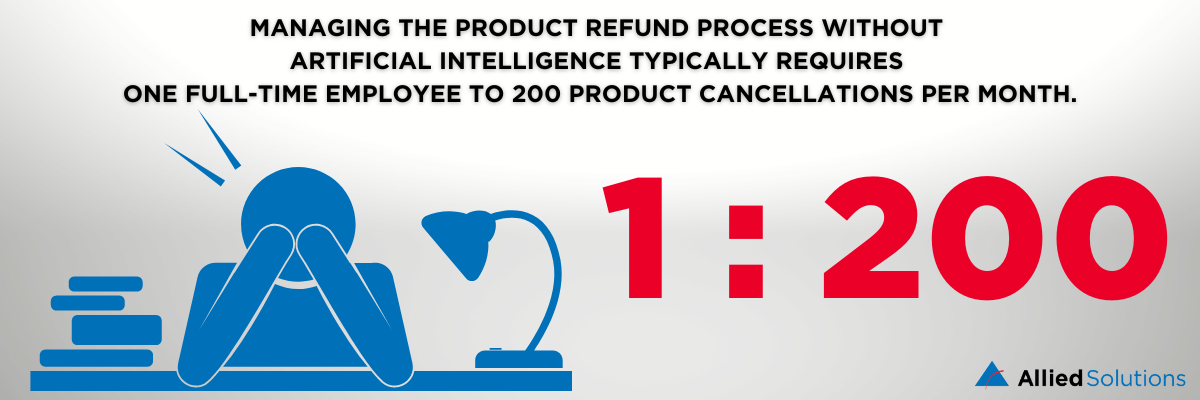

Artificial intelligence (AI) continues to grow in both popularity and use cases, and product refund management is an ideal application for AI. To manage the product refund process manually (without AI) typically requires one full-time employee dedicated to 200 product cancellations per month. Managing the process without automation requires dedicated and highly trained staff, oversight from multiple internal departments, and off-the-cuff knowledge of shifting regulations to adjust processes accordingly.

On the flip side, automating the management of product refunds does the work of full-time employees while still giving financial institutions the control over the process. Product refund automation not only eases the workload on staff, but also reduces errors in the refund calculation process that could be revealed in an audit.

Why did we invest millions of dollars to build a technology that helps lenders automate product refunds? Here’s why.

Take Control of the Process Without Burning Out Staff

It is a common misconception that managing product refunds in-house will reduce costs. However, the cost of hiring, training, and retaining talent to manage the process is high, and the consequences of mis-managing the process can be even more costly, both financially and reputationally.

With a fully automated product refund management platform, your financial institution can take control of the product refund process without burning out existing staff or hiring new talent.

Lenders that are outsourcing the complex, labor-intensive product refund process are:

- Recovering refunds faster

- Maintaining better regulatory compliance

- Ensuring refund accuracy

- Increasing consumer satisfaction

Is your financial institution ready to take control of product refunds? Find out how.

About Allied Solutions

Allied Solutions, LLC is one of the largest providers of insurance, lending, and marketing products to financial institutions in the US. Allied Solutions uses technology-based products and services customized to meet the needs of over 4,000 banks and credit unions, along with a portfolio of innovative products and services from a wide variety of providers. Allied Solutions maintains several offices strategically located across the country and is a subsidiary of Securian Financial Group, Inc.