Whether you’ve jumped aboard the crypto train or are cautiously still waiting at the station, the best way to fortify your credit union and the security of your members, is with Zero Trust Architecture (ZTA). That’s to say – “never trust, always verify”, says the concept founder, John Kindervag.

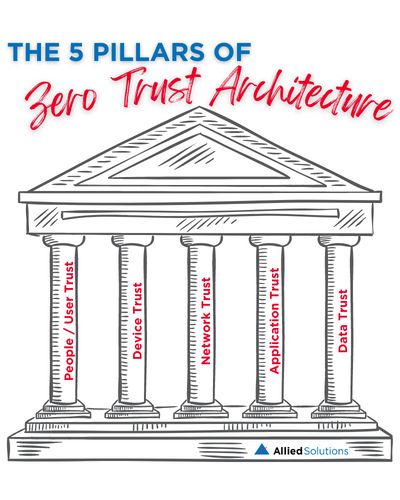

The 5 pillars of zero trust:

- People/User Trust

- Device Trust

- Network Trust

- Application Trust

- Data Trust

This concept might be known by another name within your organization, or just in the beginning stages of implementation. Regardless of where you are in the process, ZTA means diving into complexity, utilizing your budget, and dedicating time, if your credit union doesn’t already. To achieve success, it’s vital to find the right balance between your people, processes, and technology.

Drawing back the digital curtain

It’s widely believed that cryptocurrencies like Bitcoin and Ethereum or other forms of digital currency will change the future of global finance. These digital assets are decentralized, independent, and unregulated, operating free of central banks. These features make them both attractive and free of fees. This fact alone presents an excellent opportunity for both companies and individuals to attain wealth, which is also why there’s an increased concern around cybersecurity. For every opportunity to make money, there is an equal, if not greater, desire by bad actors to exploit it.

Read the full article here.