Every financial institution out there should have EMV enabled for ALL of your issued debit cards, credit cards, and ATM machines for which you own or are liable. If you are not currently 100% EMV enabled across all of your cards and ATMs it is nearly a guarantee that your financial institution will be forced to deal with one of the following financial loss occurrences in the very near future:

- Magnetic stripe counterfeit card fraud on your non-chip enabled cards

- Fraud using chip-enabled cards on your non-chip enabled ATMs

- Fraud at a chip-enabled ATM using your non-chip enabled cards

Enabling EMV technology on all of your cards and ATMs may take some time and money to do, but the benefits of adopting the technology across the board hand-over-foot outweigh the costs of not doing so.

Majorly these benefits fall into two buckets: Risk Management and Consumer Service.

Reduce Your Risk of Fraud

Card Fraud Prevention

It makes sense that most financial institutions began implementing EMV on credit cards. Credit cards tend to be used by consumers to purchase higher priced items and were therefore deemed a juicier target for criminals to commit card fraud. But now, fraudsters are seeking to commit fraud on any and all non-chip enabled cards, regardless of whether they are debit or credit cards.

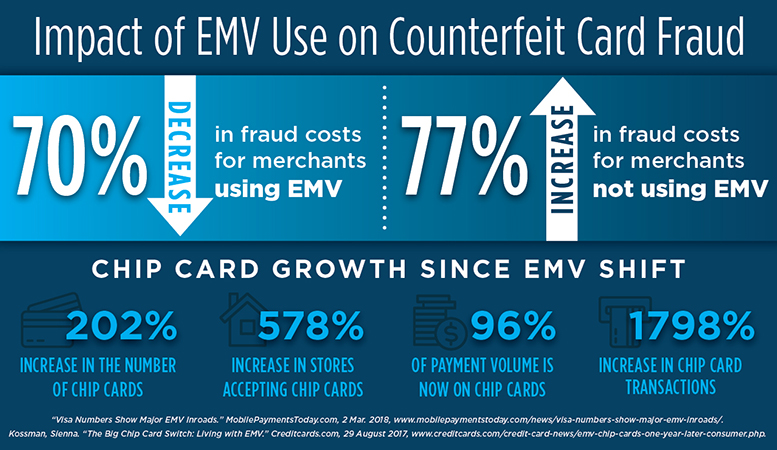

In fact, Mastercard reported seeing a 77% increase in counterfeit card fraud year-over-year among merchants who have not moved to EMV or are in the early stages of doing so.

On the flip side, Visa reported a 70% drop in the dollar amount of card fraud from September 2015 (one month before the EMV shift) to December 2017, largely due to the increased proliferation, adoption, and usage of chip cards over non-chip cards.

In other words, if you don’t enable EMV on your entire debit and credit card portfolio you are opening the door for criminals to more easily come after your business for card fraud.

To protect your EMV card programs, it is necessary you adopt chip fallback authorization strategies that will reduce your risk of fraud exposure.

Learn more about these fallback authorization practices so you can better manage EMV fallback fraud risks on your chip-enabled cards.

ATM Fraud Chargeback Prevention

ATM fraud losses and chargebacks is another big area of risk your business can vastly reduce with EMV implementation ever since the ATM chargeback liability shifts in 2016 (Mastercard) and 2017 (Visa).

Your financial institution would be financially liable for EMV related ATM fraud losses if one of the following occurs:

1.Card Issuer Chargeback: Your financial institution will receive chargebacks as the card issuer if your issued cards are not chip-enabled and fraud occurs at a chip-enabled point of sale device or ATM.

2.Card Merchant Chargeback: Your financial institution will receive chargebacks as the merchant if fraud occurs using another card issuer’s chip-enabled cards at your non-chip enabled ATMs or in-branch point of sale devices.

I recently learned about a fraud exposure where the financial institution owed $400,000 in “merchant chargebacks” to the card issuer because they didn’t have their ATM chip-enabled, but the card issuer’s cards were chip enabled. For a smaller sized financial institution, this unplanned loss was quite a blow to their finances and operations.

As this example demonstrates, an EMV related ATM fraud exposure can be quite debilitating for a financial institution, so don’t wait to work with your ATM vendors to make the switch on all of these devices.

It is equally as important that you know how to prevent EMV fallback fraud exposures on your ATMs with sound fallback authorization strategies.

Learn more about how to best protect against EMV fallback fraud risks on your ATMs.

Enhance Consumer Trust and Relationships

Consumers’ perceptions of EMV versus non-EMV cards should also not be overlooked. With reports of data breaches and cybercrimes becoming more mainstream in the media, consumers are growing increasingly more concerned about these crimes. As such, more and more consumers are moving toward using payment methods that promise to be more secure.

According to a 2018 Fiserv Survey, inserting a chip card is now the most preferred way to make a payment, with 36% of consumers (compared to just 27% in 2017) preferring this payment method over other forms of payment, such as swiping a card or paying with cash or check.

The appetite amongst consumers for more secure payment methods is increasing every year, so if you have yet to switch 100% of your credit and debit cards to EMV cards, you run the risk of losing card-carrying consumers to financial institutions that have fully adopted this secure technology.

Not only that, if you offer your consumers this more trusted payment technology, they are much more likely to use your chip-enabled cards to make more frequent, or even larger, purchases.

If you still have not switched to EMV for ALL of your cards and ATMs, fraudsters are sure to come after your business, and soon! Start building a plan now for updating your ATMs with chip-enabled technology and performing a mass reissue on all of your remaining non-chip enabled cards. It may seem like a bit costly up front, but trust me when I say this cost is NOTHING compared to what could happen if you don’t make this comprehensive transition.

Don’t Allow History to Repeat Itself!

Think back to the 90's when CVV/CVC cards were being rolled out: Many financial institutions waited to implement CVV/CVC cards as they came up for renewal, rather than doing a mass reissue unless they were hit with fraud. Some even said they weren’t going to issue them at all. Inevitably what ended up happening is the fraud on these non CVV/CVC enabled cards got so bad, that Visa and Mastercard decided to mandate the use of CVV/CVC cards nationwide.

It is said that mistakes happen so that we can grow and learn from them. I’d say this is one huge mistake not worth repeating. Wouldn’t you?

Download "Risk Checklist: Chip Fallback Authorization Strategies to Reduce Fraud Impact" to uncover EMV authorization strategies you should adopt to better manage fallback fraud on your cards and ATMs.

Learn more about our EMV integrations tools and other card and ATM solutions.