Attracting and retaining top talent is a priority for credit unions of all sizes. Standard benefits may not suffice for highly compensated employees, posing challenges in maintaining competitiveness. Executive benefit programs offer a competitive advantage when recruiting new leaders by enhancing total compensation and demonstrating a long-term commitment. Gallagher helps ensure these plans align with goals of an organization as well as the expectations of key executives.

Gallagher conducts an annual survey and provides a full report of the data including extensive analysis with digestible charts and tables. This report is provided to all survey participants as a complimentary resource that is also available upon request.

The Survey

The Gallagher Executive Compensation and Benefits Survey is a valuable resource for decision-makers. This year’s report contains data from 725 credit unions and 2,530 executives including the Chief Executive Officer, Chief Financial Officer, and next four highest compensated executives.

Hundreds of data points, grouped by asset size, help credit unions understand how they compare to similarly sized credit unions.

Three Key Findings

-

- Increasing Compensation:

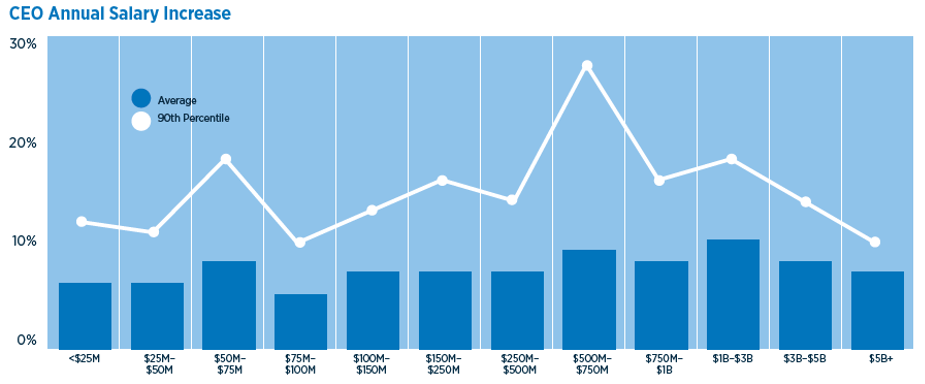

- For two years in a row, the average CEO annual salary increased by 7%. This growth has more than doubled since 2014.

- The demand for exceptional talent – fueled by aggressive strategic goals, mergers, focus on succession planning, and CEO retirements – is driving the growth in compensation.

- CEO annual bonuses or incentives have also seen a notable increase, now averaging 20% of salary, up from 14% last year. The target bonus generally increases with asset size.

- Usage of Nonqualified Benefit Plans:

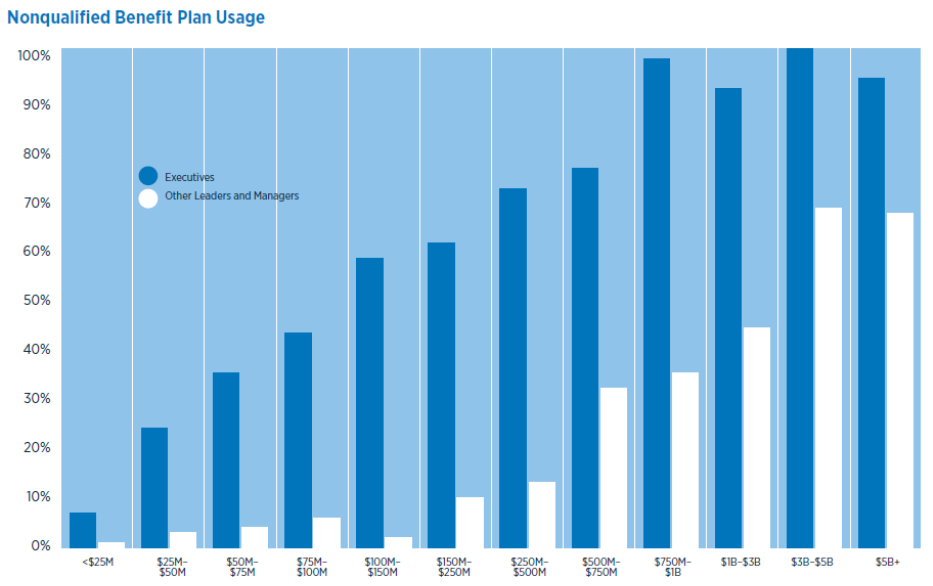

- Among credit unions with assets totaling $100 million or more, 75% of executives and 23% of other leaders and managers receive nonqualified benefit plans. Usage of these plans increases with the size of the institution's assets. At $750 million in assets and greater, usage for C-suite executives reaches nearly 100%.

- Among credit unions with assets totaling $100 million or more, 75% of executives and 23% of other leaders and managers receive nonqualified benefit plans. Usage of these plans increases with the size of the institution's assets. At $750 million in assets and greater, usage for C-suite executives reaches nearly 100%.

- CEO Demographics:

- Nearly one-third, 29%, of CEOs are aged 60 years and older. While this percentage has remained relatively stable over time, it's essential to recognize the implications of CEOs nearing retirement for recruitment, succession planning, and retention efforts. Given the post-pandemic trend of early retirements, the fact that half of CEOs are aged 55 years and older may raise concerns about leadership continuity and transition strategies.

- Increasing Compensation:

Check out Gallagher’s Preferred Partner Interview with Allied Solutions

Regular benchmarking of executive compensation and benefits against peers is crucial for credit unions to remain competitive in the talent market. It helps ensure that compensation packages align with industry standards and meet the needs of executives.

In managing total compensation, credit unions need to consider the competitive talent market, regulatory compliance for nonqualified plans, prioritize succession planning for CEOs nearing retirement, and tailor benefit packages to individual preferences. This comprehensive approach helps ensure effective talent attraction, regulatory adherence, organizational stability, and executive satisfaction.

About Gallagher

Gallagher is one of the world’s largest insurance brokerage, risk management and consulting firms. As a community insurance broker and trusted local consultant, we help people and businesses move forward with confidence. With more than 39,000 people working around the globe, we’re connected to the places where we do business and to every community we call home. Managing risk with customized solutions and a full spectrum of services, helping you foster a thriving workforce, and always holding ourselves to the highest standards of ethics to help you face every challenge—that’s The Gallagher Way.

Gallagher’s Executive Benefits Team helps design and deliver a better workplace through a comprehensive approach to executive benefits, staff total rewards, compensation, retirement, culture, and more. We consult with credit unions and boards on strategies to attract and retain their key leadership. We specialize in compliance, due diligence, investments, and in-house program administration. Learn more at www.gallagherexecben.com.

About Allied Solutions

Allied Solutions is one of the largest providers of insurance, lending, risk management, and data-driven solutions to financial institutions in North America. Allied Solutions uses technology-based solutions customized to meet the needs of over 6,000 banks, credit unions, finance companies, mortgage servicers, and auto dealers, along with a portfolio of innovative products and services from a wide variety of providers. Allied Solutions is headquartered in Carmel, Indiana and maintains several offices strategically located across the country. Allied Solutions is a wholly owned and independently operated subsidiary of Securian Financial Group.