Natural disasters and catastrophes can move people to donate to causes helping individuals and communities with the fallout of a natural disaster. Unfortunately, best intentioned donors can become the victim of a charity scam. It is a sad reality that these types of fraud spike in the wake of a major event or catastrophe, such as a hurricane, earthquake, tornado, wildfire, or flood. But your financial institution doesn’t have to sit by and wait for members to fall prey. Help keep your employees and accountholders educated on these scams so they can spot them and stay protected.

How the Scam Is Played Out

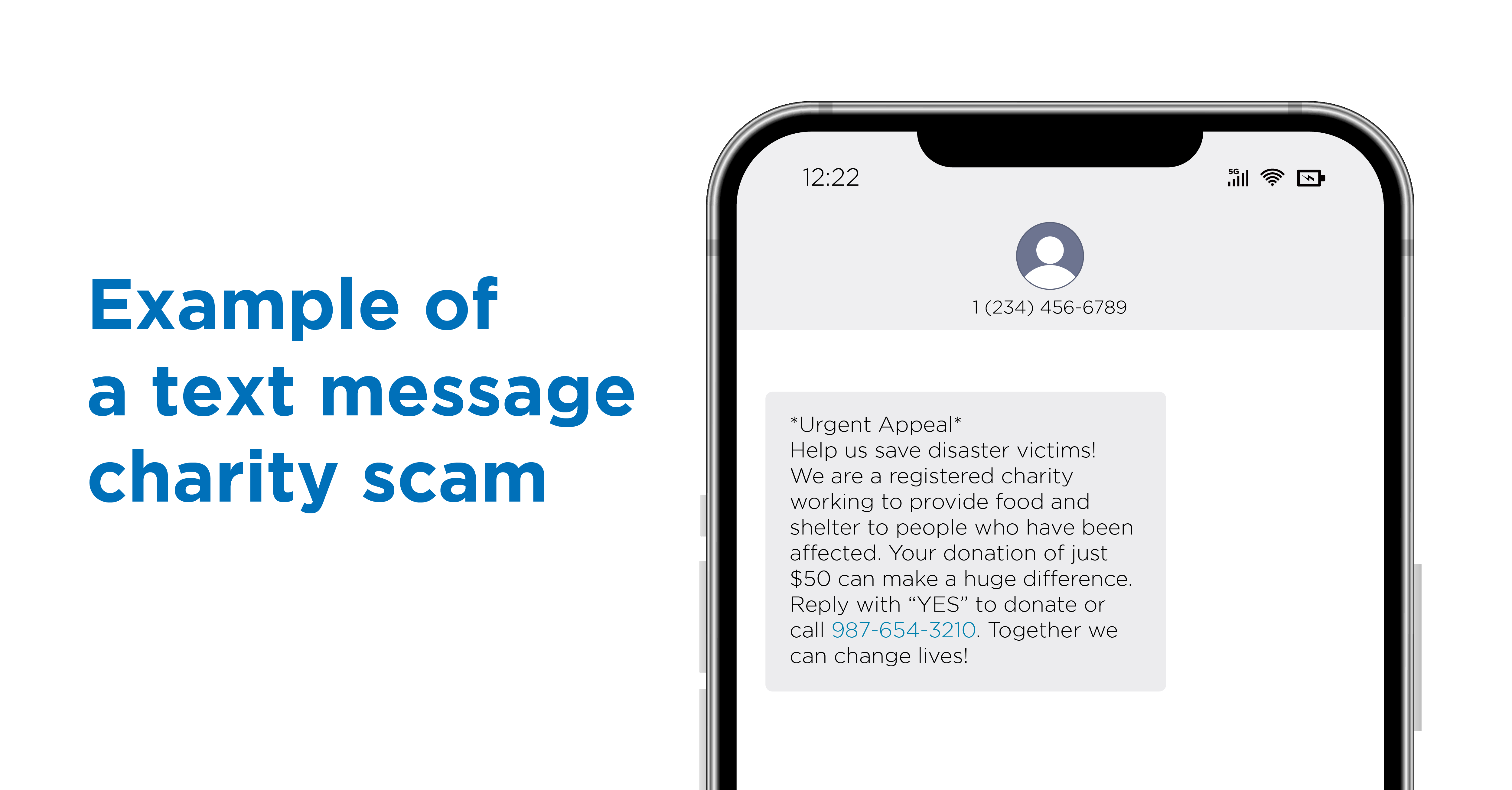

The culprits of this fraud typically use email, text, phone calls, or social media ploys to lure victims to send money to a bogus charity or to download malicious software so they can then gain access to the private information on their device.

Do’s and Don’ts of Charity Scams

The best defense against these types of fraud are aware and educated consumers. Share these do’s and don’ts with your accountholders (especially during hurricane season) to help keep them protected.

Do…

-

- Avoid cryptocurrency only donations. It’s very unlikely that an established organization would only accept crypto as a form of payment.

- Know if your donation is tax deductible. Check the IRS’s tax exemption search tool to determine an organization’s eligibility.

- Report suspicious email solicitations or fraudulent websites to the FBI's Internet Crime Complaint Center.

- Research the organization before donating by using a search engine with the organization’s name + scam. (i.e. Red Cross scam) or check the FTCs page on safe donations.

- Be skeptical of individuals representing themselves as members of charitable organizations or officials asking for donations via email or social networking sites.

- Beware of organizations with copy-cat names similar to — but not exactly the same as — the names of reputable charities.

- Be cautious of emails that claim to show pictures of the disaster areas in attached files because the files may contain viruses. Only open attachments from known senders.

- Make contributions directly to known organizations rather than relying on others to make the donation on your behalf.

- Be wary of organizations with website URLs ending in ".com" or “.net” claiming to be charities. Most legitimate charities have website URLs ending in ".org.”

Don’t…

-

- Pay anyone demanding money, even for a supposed good cause.

- Be pressured into making contributions; reputable charities do not use such tactics.

- Respond to any unsolicited incoming emails, and do not click links contained within those messages, because they may contain viruses.

- Respond to any charities soliciting donations via money transfer services or social media.

For more natural disaster preparedness strategies for financial institutions, watch for our free resource guide.

How FIs Can Help Fight Fraud

FIs can help fight fraud losses from charity scams by:

-

- Giving members the tools (like the ones in this blog) to detect a charity scam and lessen fraud losses.

- Working with all third-party vendors to ensure their communications with your consumers are clearly labeled on your behalf and are specific to their issue. For example, call scripts should include: “We are calling on behalf of [insert financial institution name] in regard to the recent water damage to your home on 123 Main Street.”

The aftermath of natural disasters leave those affected fearful and uncertain and grappling with losses. With the support of your employees and consumers, you can thwart scams like these to prevent loss exposure.

Click here to subscribe to Allied’s take on industry trends, education, and insights.