The world of auto finance is broad and complex, and the evolving economic and regulatory environment is only adding to the complexity. As dealers and creditors increase their focus on revenue streams from ancillary product sales, those products in turn receive heightened scrutiny from regulators and legislators. Of late, that scrutiny has been expressly close with Guaranteed Asset Protection waivers (GAP) and on liability for refunds when GAP is canceled prior to termination of the underlying vehicle finance agreement.

The CFPB (Consumer Financial Protection Bureau) is strongly scrutinizing refund processes and is issuing penalties in the tens of millions of dollars for violations to creditors with $10B or more in assets. In addition, the number of state laws specifically addressing GAP and the issue of refunds specifically is also increasing. California recently passed two pieces of legislation (Assembly Bill 2311 and Senate Bill 1311) which not only restrict the sale of ancillary products to military members in certain situations, but explicitly place liability for GAP refunds on creditors who receive GAP waivers sold by dealers in conjunction with the assignment of retail installment sales contracts from dealers to the financial institution.

GAP is a voluntary non-insurance product attractive to many borrowers because it provides a waiver of all, or a portion of, a borrower’s deficiency balance in the event of a total loss. However, there are a number of circumstances in which a GAP waiver may be terminated, without a benefit paid to the borrower, prior to the termination of the underlying vehicle finance agreement that triggers a responsibility upon the creditor to ensure the borrower receives a pro-rated refund of the amount paid for the waiver. These circumstances, called ‘triggering events may include:

- Early loan payoff

- Repossession and sale of collateral

- Total loss of collateral

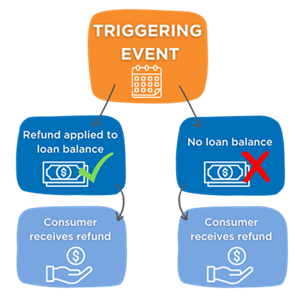

When a triggering event occurs, and the obligation of the creditor to issue the refund commences, time is of the essence to contact the appropriate parties, request a refund, and issue those funds to the borrower or apply them to the deficiency balance (if any). As such, a refund may be due to the borrower(s), which can typically travel one of two paths:

1) After a triggering event, and if allowed by state law, the refund may first be applied to any deficiency balance, with the remainder allocated to the borrower.

2) Where no deficiency balance exists, or where prohibited by law, the full refund should be dispersed directly to the borrower.

State law or regulators may offer guidance on whether GAP refunds may be applied to a loan balance, and it is important to secure legal advice specific to the jurisdictions in which you operate to determine the best approach for your financial institution.

Financial institutions will continue to be scrutinized by regulators to ensure they maintain a compliant and consumer friendly process and issue timely refunds to consumers. As the compliance landscape begins to resemble that of a regulatory battlefield, industry practices require a proactive approach focused on doing right by the borrower first and foremost.

A timely and compliant product refund process is a critical piece in a creditor’s toolkit given that the majority of auto loans that are paid off early have at least one ancillary product attached. But calculation and actualization of refunds can be tricky and manual processes are cumbersome and expensive. Learn more about this complex process from Allied and partners F&I Sentinel and Cox Automotive on this Q3 webinar Real Talk on Refunds.