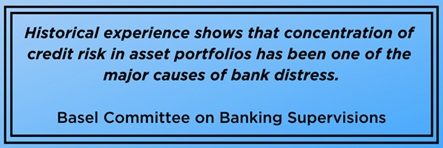

During this time of “are we or are we not in a recession,” banks and credit unions should be focusing on actions that can generate revenue and mitigate potential risks. It’s the job of the institution’s management to discover, monitor, and control any concentration risks while keeping interest rates and liquidity risks in mind. Concentrating on building a diverse portfolio is crucial to achieving both goals and was recommended by the National Credit Union Administration (NCUA) following the 2008 financial crisis (PDF download). In order to properly diversify, a financial institution should pay special attention to the purchased loans’ risk exposures to ensure they are a different asset class than the loans in the institution’s current portfolio. To help prevent a case of history repeating itself (in case we are smack dab in the middle of a recession), here are a couple of ways financial institutions can better prepare themselves for whatever happens next.

A Whole Solution

Interest rates are up, and so are home values. Homeowners are taking advantage of their newfound home equities and turning that extra cash into home improvements, swimming pools, college tuitions, and more thanks to the increasingly popular second mortgage. However, homeowners aren’t the only ones able to benefit from second mortgages. Financial institutions can increase revenue by taking similar advantages of the higher interest rates.

High-volume loan originators often sell off whole loans in the secondary market to institutional portfolio managers and agencies to reduce risks and clear their balance sheets. You may think these buying opportunities are only for the big names in the industry, but with the right tools, the financial institution next door can easily capitalize on them too.

Increasing revenue is typically the goal, and if you are a credit union, improving your loan-to-share ratio may not be far behind. The more opportunities you have to purchase new loans, the better your chances are of achieving each (if applicable). But how can your institution do this without the time and exhaustion it takes to hire and properly train a full-time person to seek out these opportunities? Enter – a whole loan flow. A whole loan program packages up high-yield, second-lien loans for your institution to invest in - which can be especially desirable and opportunistic in a high-interest market where yields can average north of 5.7%.

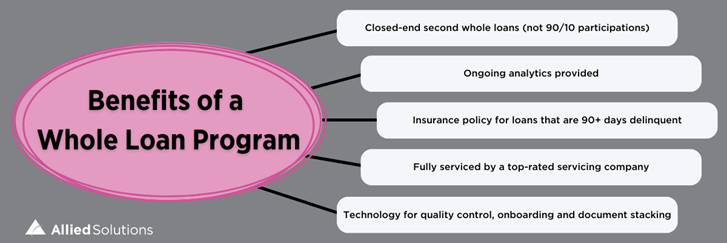

Whole loan programs can offer more than a package of second-lien loans. If investing in the right solution, a whole loan program has the ability to keep your institution protected with benefits such as loan default insurance, provide loan data analytics, and be fully serviced by a third-party servicer to save your institution time and resources.

Participating in Participation Loans

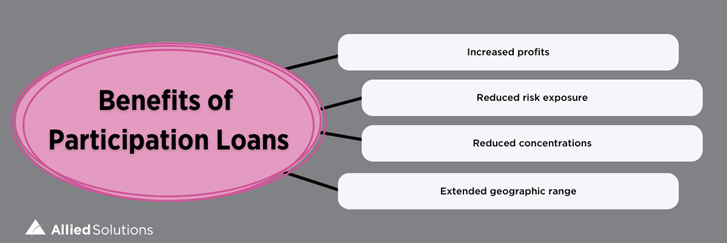

Whole loans aren’t the only way to take advantage of today’s interest rates. Participation loans also provide excellent opportunities to diversify your portfolio, boost your bottom line, and help mitigate the effects a recession has on the institution. By chipping in on these pools of loans, your institution can benefit from flexible loan growth and grow loans with low credit risk and above-average yields. Similar to a whole loan program, with the right tools, your institution can generate revenue by purchasing participation loan packages that are managed by top-rated servicing companies, again saving a financial institution the time and resources to hire and train a new employee(s). The ability to gain financial momentum with a chance of reduced risk is especially beneficial for institutions in slower markets or those with a loan-to-share ratio that is lower than desired.

Now, maybe more than ever, is the time for banks and credit unions to drill down and focus on the diversification of their portfolios. With a combination of variable rate participation and whole loan pools, both are powerful tools to ladder your asset risks and can help keep your institution afloat in what could potentially be some choppy waters.

Stay Informed with Resources from Allied Solutions: Join our e-newsletter list!