An FI's Guide to Young People Part Two: When Fantasy Becomes Reality

If you are in a particular age range, you probably remember KITT – the sassy, black, Pontiac Firebird Trans Am from the 80s television show Knight Rider. Ahead of its time, KITT was equipped with a self-aware cybernetic logic module that allowed it to think, learn, communicate, and interact with humans – as it did with its owner, Michael (David Hasselhoff) via a walkie-talkie type wristwatch. KITT was the car of the future. Together, they righted the wrongs of the day and drove off into the sunset until the next episode.

But that was just for television, right?

Today, in the 2020s, a car like KITT isn’t so far-fetched when vehicles can now drive and park themselves. Artificial intelligence (AI) has been a trending acronym for the better part of the last year with the onset of generative AI programs such as ChatGPT, Bard, and DALL-E - which can create text, images, and other media based on various prompts and what the user instructs it to create.

If you missed part one of An FI’s Guide to Young People, you can catch up on all the lingo here.

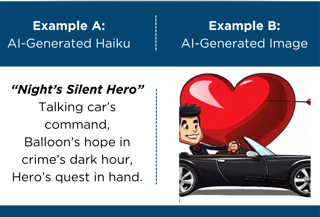

Before you say “huh?” or let your eyes glaze over - here’s an example:

Not only can you ask or prompt one of these AI programs to write a haiku (complete with a title) about a leather-clad crime fighter who drives a black, talking car and (to make things interesting) is also holding a heart-shaped balloon, but you can also have it create an image to accompany it – in this case, a cartoon version.

We didn’t say it would be good, but it can be done.

WIIFM (What’s in It for Me)?

While the sudden bombardment of AI can seem overwhelming, don’t overlook it. AI goes way beyond the hype of the consumer-facing sites, such as a ChatGPT. In fact, financial technology product companies are investing in ways to implement various forms of AI into their products in order to be more effective for your institution’s benefit.

For example, the video editing platform SundaySky recently launched, Copilot, their AI-enhanced service that makes creating fast, easy, and effective videos even faster and easier with the addition of AI prompting. These types of advancements in the digital space can help set up your institution for imperative growth. Focusing here is especially important for credit unions, because:

· Only 4% of Gen Z are credit union members (PYMNTS + PSCU)

· Only 5% of Millennials are credit union members (PYMNTS + PSCU)

· 48 years is the average age of a credit union member (CUInsight)

· 78% of consumers prefer to handle their finances online (Forbes Advisor)

And as the young people would say, that’s “no cap.”

Your marketing efforts can also benefit from a little AI makeover. Digital marketing optimizations are helping institutions’ marketing dollars go further by eliminating the waste and dead ends of the customer’s journey.

The Do’s and Don’ts of AI

The future of AI in the financial industry is a story waiting to unfold. As it makes its way into every nook and cranny of the business, one wouldn’t be hard-pressed to assume that it’s not going away anytime soon. Instead, it will continue to grow and transform and work for those who let it. You shouldn’t rely on AI to be your next full-time employee, but it can be a tool to help your current employees be more efficient at what they do.

Consider using AI capabilities to:

· Predict borrower behavior

· Improve customer service

· Detect fraud

· Create content ideas for your website, blogs, etc.

· Create a social media calendar

· Create videos that can educate and inform

· Improve your SEO

Don’t use AI to:

· Write your content (newsletters, blogs, etc).

o It can pull inaccurate information

o Lacks any sort of cultural awareness

o It can pull copyrighted material/plagiarize

· Replace humans or entire jobs

But DO use AI to get in front of those young people and tackle that pesky lack of millennials and Gen-Z problem! You can scream your benefits and services from the tops of mountains, but if their heads are buried in devices, they won’t hear you. Be where they are (their phones) and be able to service their needs when and where they want (24/7, on their phones). Not only will you be the “main character” in their financial journey, they will applaud you for “understanding the assignment.”